Courtesy of: Bill Conerly

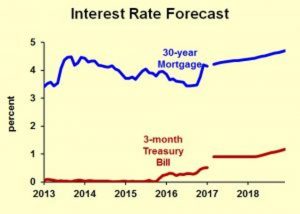

The Federal Reserve seems inclined to raise interest rates three times in 2017, but as the data come out, they’ll stick with one and done.

The Fed’s course of action is always “data dependent,” their phrase for making it up as they go along. Thus their plans are only as reliable as their forecasts, which don’t have a great track record. The most recent minutes of the policy committee (the Federal Open Market Committee) show that members continue to expect rate hikes over the course of the year.

Here’s why I think they are wrong to expect continued economic expansion, and thus the need for tighter monetary policy: businesses will drag their feet on discretionary spending. That includes contracts for new construction of buildings, purchase orders for equipment and information systems, and hiring of workers. This delay in spending comes from uncertainty affecting major parts of the economy.

Policy toward foreign trade is uncertain at this time, impacting companies that export as well as those that import goods for resale, those that import components for manufacturing, as well as businesses involved in transportation and warehousing. All of these sectors account for 33.6 percent of GDP, according to the federal statistics on gross output by industry.

Immigration policy is uncertain. It seems highly unlikely that the government would devote enough resources to find and deport every illegal alien. But that federal audits of employees’ legal status will be stepped up, putting several industries at risk. (I cited a list of at-risk industries in my article, Business Strategy Can Protect Against Trump’s Stepped Up Immigration Enforcement.) Businesses most at risk are in agriculture, construction, restaurants/hotels, business and other services, and manufacturing. These industries account for 27.2 percent of GDP.

What about ObamaCare? Physician practices and hospitals are all nervous about the future of health care spending, and they constitute 6.5 percent of GDP. Add to that health insurers, pharmaceutical companies and medical device manufacturers (for which I don’t have data).

There is some double-counting in the percentage cited above. Eliminating that, Roughly 49 percent of the economy is subject to high uncertainty from Trump administration policies (after eliminating double-counting in the percentages cited above). [This is a corrected figure. An earlier draft of this article was published with an incorrect figure of 67 percent.] And some of the remaining industries should also be nervous. Banking, for example, has many customers in the uncertain sector. Education is up in the air about federal policy. Utilities are wondering about climate change initiatives that affect their fuel choices. The list of uncertainties goes on and on and on.

Uncertainty always exists for businesses, but sometimes it is more pronounced. The transition to the Trump administration is one of those times of more pronounced uncertainty. Most companies that had expansion plans will expect to go forward. But maybe they won’t break ground next month, or sign the contract just yet, or give a manager hiring authority for a while. When delays in spending spread across a wide swath of the economy, growth must slow.

With slower growth, the Federal Reserve members will slap their foreheads and say “By golly, Bill Conerly is right, the economy is not strong enough to justify three rate hikes in 2017.”

Next year, though, much of the uncertainty will be over and companies will make up for lost time. Mining and petroleum drilling will increase due to federal policy changes. The economy will strengthen and the Fed will then tighten. Right now I believe they will be gradual, but even my forecast is “data dependent.”

For more articles like this, visit: www.forbes.com

Not intended as a solicitation if your property is already listed by another broker. LPT Realty, LLC is a Licensed Real Estate Brokerage.

Not intended as a solicitation if your property is already listed by another broker. LPT Realty, LLC is a Licensed Real Estate Brokerage.