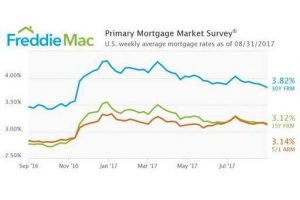

MCLEAN, VA–(Marketwired – Aug 31, 2017) – Freddie Mac ( OTCQB : FMCC ) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average mortgage rates continuing to move lower.

News Facts

30-year fixed-rate mortgage (FRM) averaged 3.82 percent with an average 0.5 point for the week ending August 31, 2017, down from last week when it averaged 3.86 percent. A year ago at this time, the 30-year FRM averaged 3.46 percent.

15-year FRM this week averaged 3.12 percent with an average 0.5 point, down from last week when it averaged 3.16 percent. A year ago at this time, the 15-year FRM averaged 2.77 percent.

5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.14 percent this week with an average 0.5 point, down from last week when it averaged 3.17 percent. A year ago at this time, the 5-year ARM averaged 2.83 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quote

Attributed to Sean Becketti, chief economist, Freddie Mac.

“The 10-year Treasury yield fell to a new 2017-low on Tuesday. In response, the 30-year mortgage rate dropped 4 basis points to 3.82 percent, reaching a new year-to-date low for the second consecutive week. However, recent releases of positive economic data could halt the downward trend of mortgage rates.”

Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog.

Not intended as a solicitation if your property is already listed by another broker. LPT Realty, LLC is a Licensed Real Estate Brokerage.

Not intended as a solicitation if your property is already listed by another broker. LPT Realty, LLC is a Licensed Real Estate Brokerage.